We are back with our fourth “Mobile Insights Monday” webinar. Once again, this session featured data.ai’s Principal Market Insights Manager,

Today’s webinar takes a deeper dive into the latest dataGEMS Newsletter which included:

- Streaming app’s performance following Oscar-worthy movie releases

- Tik Tok’s potential ban and the consumer spend shockwaves it would make in the USA

- Are Hypercasual games trending down, or are we seeing a new rise in their virality?

Watch this session on-demand and check out the relevant metrics below:

If you have any questions, thoughts, or your own insights from this week’s content, comment on this thread and our team will jump in to continue the conversation.

Reports:

Streaming in the Spotlight: And the Oscar Goes To...

With the 96th Academy Awards just around the corner, it's time to check in on how the top movies of 2023 reshaped the streaming app space. This year’s Best Picture nominees were well distributed across popular streaming platforms; in fact, you’d need seven different streaming apps to watch all of these films in the US.

Some of the top-grossing movies included Barbie and Oppenheimer, which were released on Paramount+ and Amazon Prime Video, respectively. Three apps are scheduled to receive multiple Best Picture nominees, including Max, Peacock and Hulu. However, it’s worth noting that American Fiction and The Zone of Interest have not yet been released on streaming apps.

Looking at the impact on US downloads, most apps saw around a 10% to 15% boost in the week following the release of one of these Best Picture nominees. Maestro helped propel 19% week-over-week growth for Netflix, while Barbie boosted Max downloads by 11%. Note that our download estimates for Apple TV, which hosts Killers of the Flower Moon, only include Google Play since we don’t estimate the app’s downloads on iOS.

One outlier was Peacock with downloads falling 42% following The Holdovers being added to the platform. However, this was in large part due to seasonal trends, with downloads being particularly high during the previous week around Christmas time. Peacock’s downloads the week following The Holdovers release were still higher than the week Oppenheimer was added to the service. Some of the Best Picture nominees have yet to be added to their streaming services, but we’ll continue to monitor the impact on app adoption when they are.

What Would a TikTok Ban Mean for the App – and for the US?

Talk of a TikTok ban is back again – and this time, the topic could gain momentum with a future vote in Congress. While this legislation might just require that ByteDance divest from TikTok in the United States and not an outright ban, we nevertheless sought to update our understanding of how important the US market is to TikTok (and how popular TikTok is in the US).

In terms of new app downloads and monthly active users (MAU), the US was a relatively small market for TikTok, with 5% of global downloads in 2023 and 6% of average MAU. China led the way at 12% with downloads for the local version, Douyin; all the more impressive considering that this figure only includes iOS downloads in China. By comparison, China had 45% of the average MAU for TikTok, which in this case does include users on both iOS and Android devices in the market.

Looking at consumer spending, however, the significance of the US market for TikTok really comes into focus. US consumers account for nearly 40% of consumer spend in the app – a truly massive figure of roughly $1.6 billion of the total $4 billion spent in TikTok globally in 2023. For context, this is more than consumers spent in other top apps like Disney+, Pandora and Bumble combined in the year.

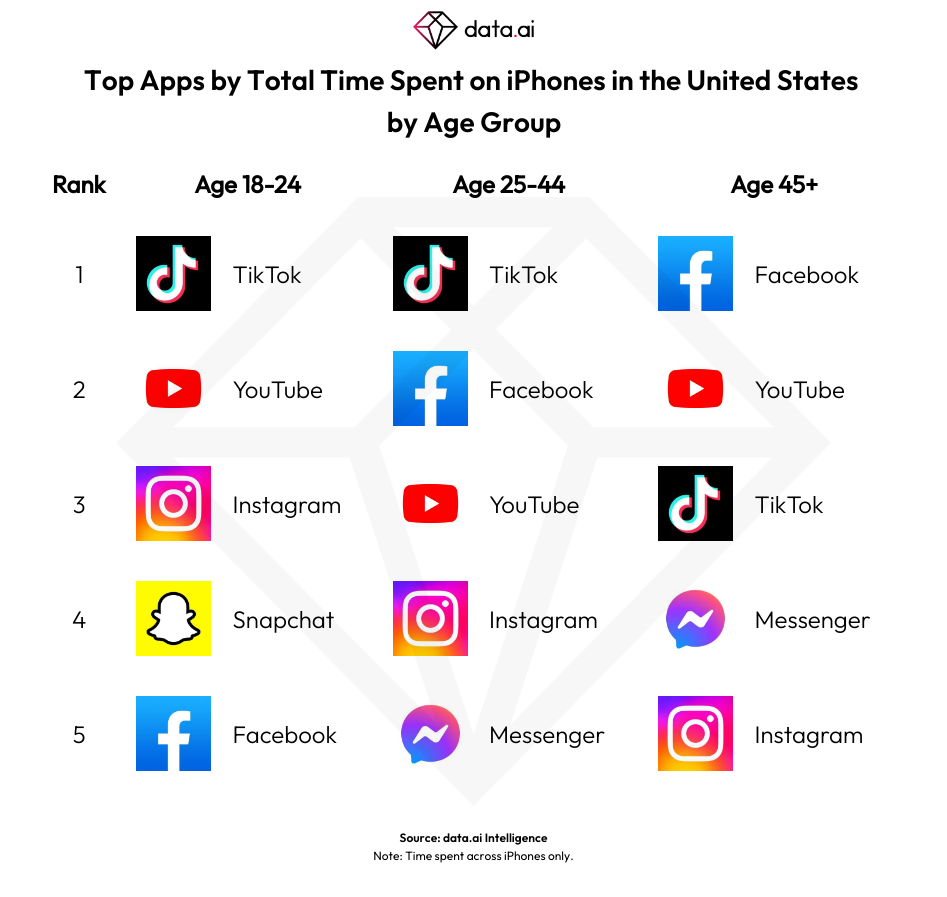

Looking at TikTok’s role in the US market, we see that it is the top app by time spent on iOS and second only to YouTube on Android. Unsurprisingly, TikTok is particularly popular among younger users, easily leading other apps by time spent among the 18-24 age group on iPhone. It also ranks #1 among the 25 to 44 age group and #3 among users aged 45 and up. Given this immense popularity and the extent to which TikTok has become part of the fabric of daily social interaction for many Americans, a potential ban could shake up the US app landscape considerably, with challengers old and new vying for its users.

Is Hypercasual Really Fading, or Still an Opportunity for Indies?

Ever since the arrival of iOS 14 resulted in the deprecation of Identifier for Advertisers (IDFA) and the impact that had on targeted advertising, the challenges this posed for Hypercasual games, in particular, came into focus. These simple, pick-up-and-play games rely heavily on advertising to monetize and naturally were expected to be hit hard.

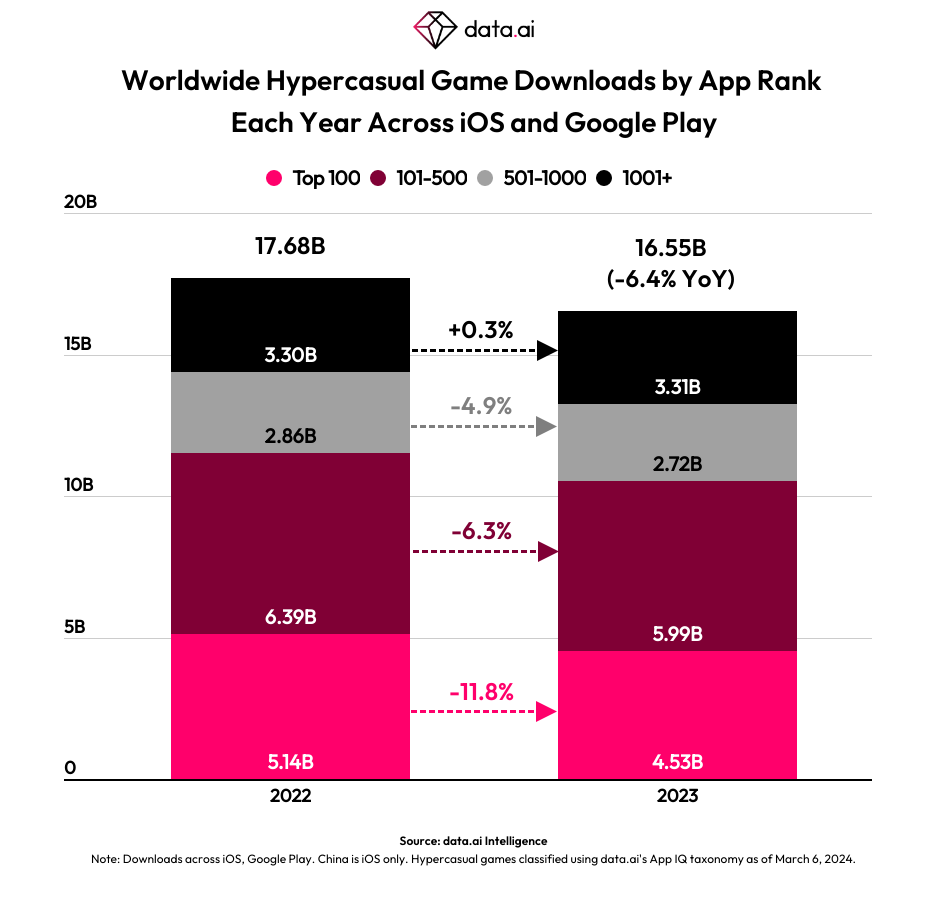

Recent download trends supported this theory. After experiencing rapid growth from 2018 through early 2022, Hypercasual game downloads declined 6.4% year-over-year in 2023. This decline, however, was most pronounced at the top. Downloads for the top 100 Hypercasual games in 2023 were down nearly 12% compared to the top 100 games in 2022. This decline was smaller for games outside the top 100, and downloads for games outside the top 1,000 Hypercasual games actually increased slightly in 2023.

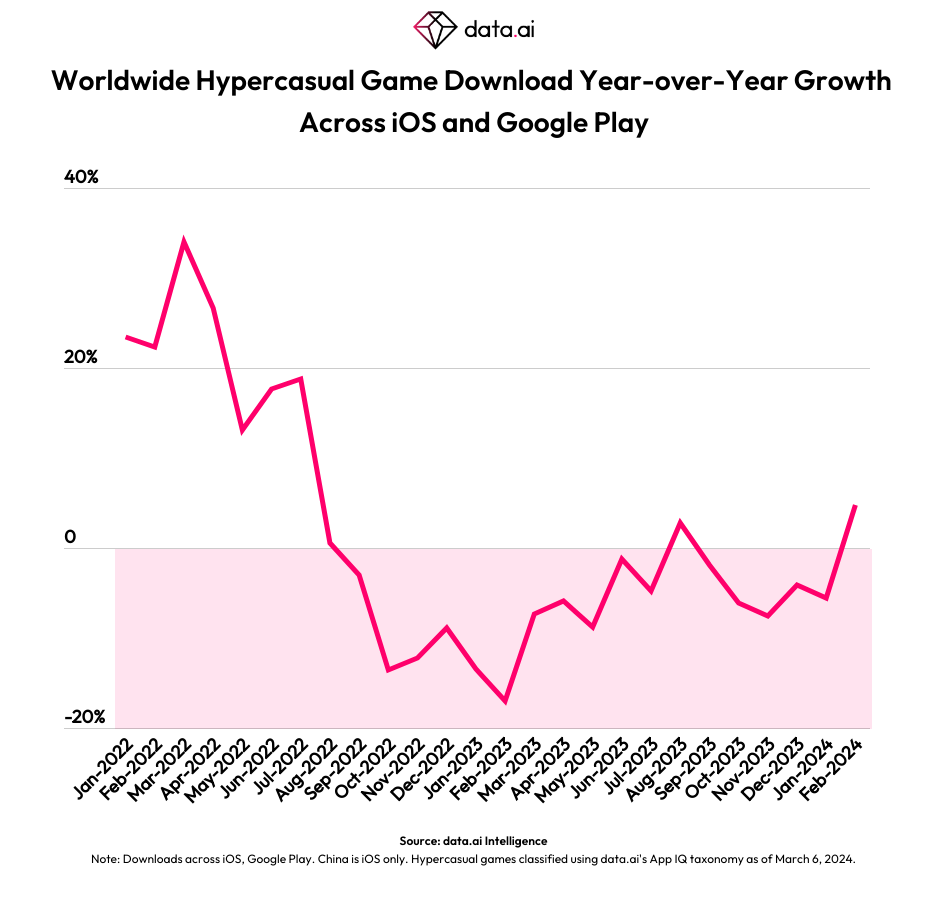

Additionally, the decline in Hypercasual downloads appears to be slowing as we enter 2024. Year-over-year growth was positive in February 2024, just the second month of positive YoY growth we’ve seen for the genre since late 2022.

Meanwhile, the vast landscape of indie developers continues to thrive, especially in the Hypercasual game sector. These games are attractive due to their low development cost and maintenance needs, coupled with the potential for viral success. This dynamic likely contributed to the sustained, albeit level, high downloads that we are seeing in early 2024.